Why are so many experts wrong about tariffs?

From tariffs to de minimis to penalties on Chinese ships, experts are increasingly wrong.

Something that has been increasingly bothering me for the past few months is why experts and analysts are so incorrect in their analysis and conclusions on things like tariffs, de minimis, penalties on Chinese ships, and so much more. Let’s start with some common examples:

Instituting penalties on Chinese ships will result in importers raising their fees, which will cause inflation.

Typically these claims will be made by an economist, an importer, a business analyst, an Amazon agency owner, or a political influencer. I have already extensively debunked by myth that Shein and Temu rely on de minimis for their business model, so we’re going to focus on tariffs today and also think about why so many people are wrong. Is it ignorance or is it intentional?

Tariff Oversimplification

Experts, particularly academics, are oversimplifying complex matters. Their logic goes something like this:

Tariffs are assessed at import.

Technically, the importer (e.g., a U.S. company) pays the bill.

Therefore, tariffs don’t hurt the exporting country (e.g., China).

Importers will likely raise prices.

Therefore, consumers are really paying for tariffs.

Higher prices = inflation.

These experts would like you to believe that tariffs are essentially a consumption tax. In reality, however, tariffs are more like a multi-variable round of Prisoner’s Dilemma (i.e., game theory).

Tariffs Drive Desired Responses and Behaviour

The objective of a tariff is to drive particular responses and behaviours from multiple actors in a space. It could be importers, exporters, consumers, producers, manufacturers, or even governments.

When a tariff is implemented, an importer has a number of ways to respond. They could negotiate with the exporter for a lower price. The exporter, if they have margin and fear losing the sale, may concede. The importer may also decide to source elsewhere to avoid tariffs. Perhaps the importer may simply decide to halt imports, especially if they have alternative products or businesses they can focus on.

Besides the importer, the other parties involved (ie - the exporter, consumers, producers, manufactures, and governments) have their own set of responses available to them as well. We won’t go over all of them, but they are varied as consumers simply choosing to buy a totally viable alternative (example - if wine from one country is tariffed, consumers have plenty of options to choose wine from a different country), and all the way to governments getting involved and countering tariffs by offering subsidies, or even implementing reciprocal tariffs of their own.

These sets of actions and responses from all parties are so numbers and unpredictable, that it is impossible to figure out the net impact on something like inflation.

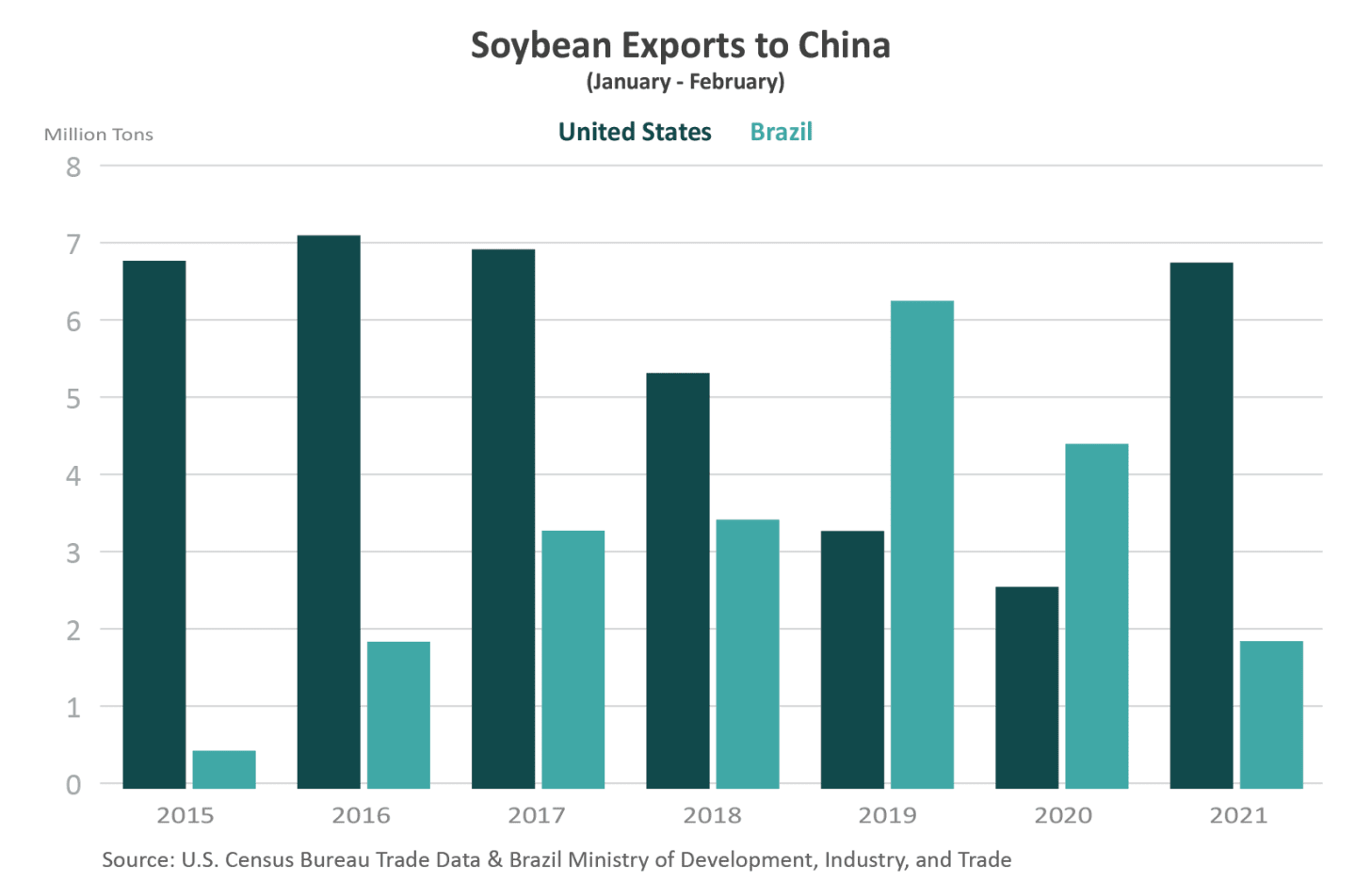

Chinese 25% Tariffs on American Soy circa 2018

We know from 1st hand experience that tariffs can hurt the exporter because in 2018, when China implemented a 25% tariff on American soy, producers and exporters were hurt badly. Faced with higher prices, Chinese importers bought their soy from other countries like Brazil. The Chinese consumer did not bear the full brunt of the tariffs as if they were a consumption tax, instead they just bought elsewhere.

Ignorance or Intentional?

In my mind, academics know better, but they live in a world where the media rewards them for sounding contrarian or predicting doom and gloom (ironically, here I am writing a contrarian piece myself). Some experts, especially those in import/export, probably know the difference too, but are intentionally going for click bait content.

I’d also bet that a significant number of commentators who repeat these oversimplifications have never imported a container from China.

For those Amazon agencies an political influencers like the one below, I believe that they genuinely don’t understand and also don’t care. They’re similarly in the business of influence and eyeballs, and the more extreme their contact, the better it does.

To be clear, this is not a political post, nor to I provide any opinion positive or negative on any of the politics.

What does the data say?

At the end of the day, let’s look at the data. We already have some empirical data points in our hands.

CMA CGM plans to invest $20B in US Shipbuilding in response to Trump policy

Walmart asks Chinese suppliers for price cuts to offset Trump tariffs

Toymaker MGA plans to move 40% of manufacturing to Vietnam

And these are the just a few headlines that I happened to come across supporting the notion that tariff policy is intended to influence behaviour. Realistically there’s a lot more on behind the scenes that will stay private.

But don’t take my word for it, let’s just revisit this in 9 months.