What's left for FedEx, UPS, and DHL

A missive for self reflection by the Big 3

In 2019 FedEx cut Amazon as a customer. It was a smart move at the time. Amazon was showing signs that it had ambitions in logistics, and it was starting to take deliveries in-house while using FedEx for coverage of less profitable deliveries.

FedEx was confident. The late Fred Smith stated on television that Amazon could not easily replicate the infrastructure and processes that FedEx had built up over 40 years.

Fast forward to 2025. Amazon has become the largest retailer in the world. Amazon Shipping, its gig-model parcel carrier service, delivers an estimated 64% of Amazon’s shipments as well as shipments for major companies like Shipbob.

As Amazon Shipping cuts deeper into FedEx’s core business, the market has responded by punishing FedEx’s stock price, while Amazon’s has soared.

The uncomfortable truth FedEx faces today is that Amazon has become a shipping company faster than FedEx has become something else. And that “something else” is precisely the problem. After years of experimentation, it’s no longer clear whether companies like FedEx, UPS, and DHL, have a growth strategy that can compensate for the systemic loss of their core parcel delivery business.

The Big 3 - FedEx, UPS, & DHL

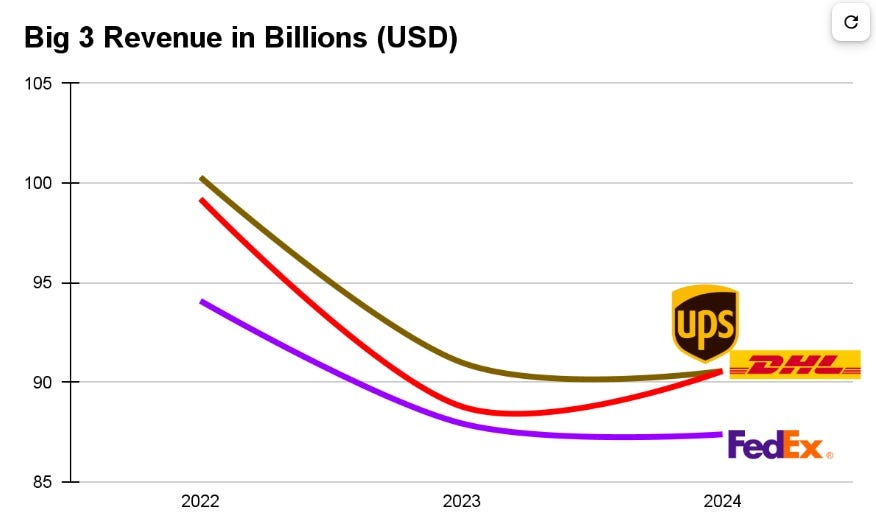

FedEx is not alone in it’s struggle. UPS and DHL are in the same boat. I refer to them as the Big 3 because they are the only true global parcel delivery companies, and they coincidentally have very similar revenues.

DHL Group $95B

UPS $91B

FedEx $87B

To the largest retailers and shippers in the world, the Big 3 are their most important parcel carriers — which is why it pains me to consider that they might possibly be in existential trouble.

Despite their scale, all 3 companies have had tremendous challenges growing their businesses. Sadly, their revenues aren’t even keeping pace with the average growth of Ecommerce, indicating loss of market share.

Preliminary results in 2025 have not been too encouraging. Random headlines spotted include:

FedEx: 100 stations closure via Network 2.0 initiative, impacting 1,000 employees

UPS: 200 stations to close, redundancy planned totalling 35,000 employees

DHL: Plans to reduce headcount by 8,000 employees

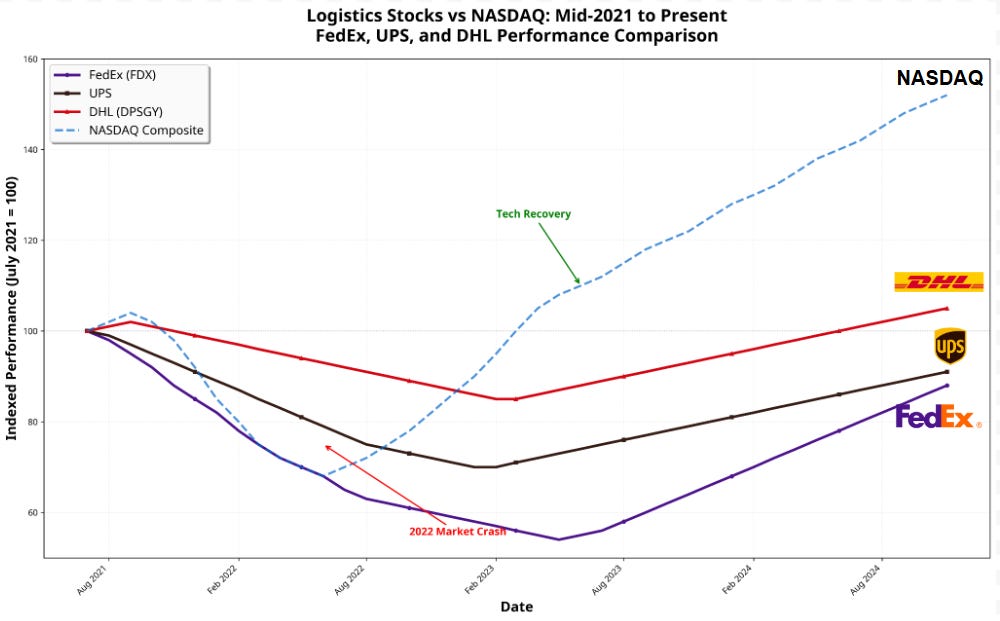

A quick look at the stock prices of the Big 3 are sobering. UPS and FedEx’s stock prices remain below their mid-2021 values while during the same period the NASDAQ index is up approximately 155%.

What’s Killing Them?

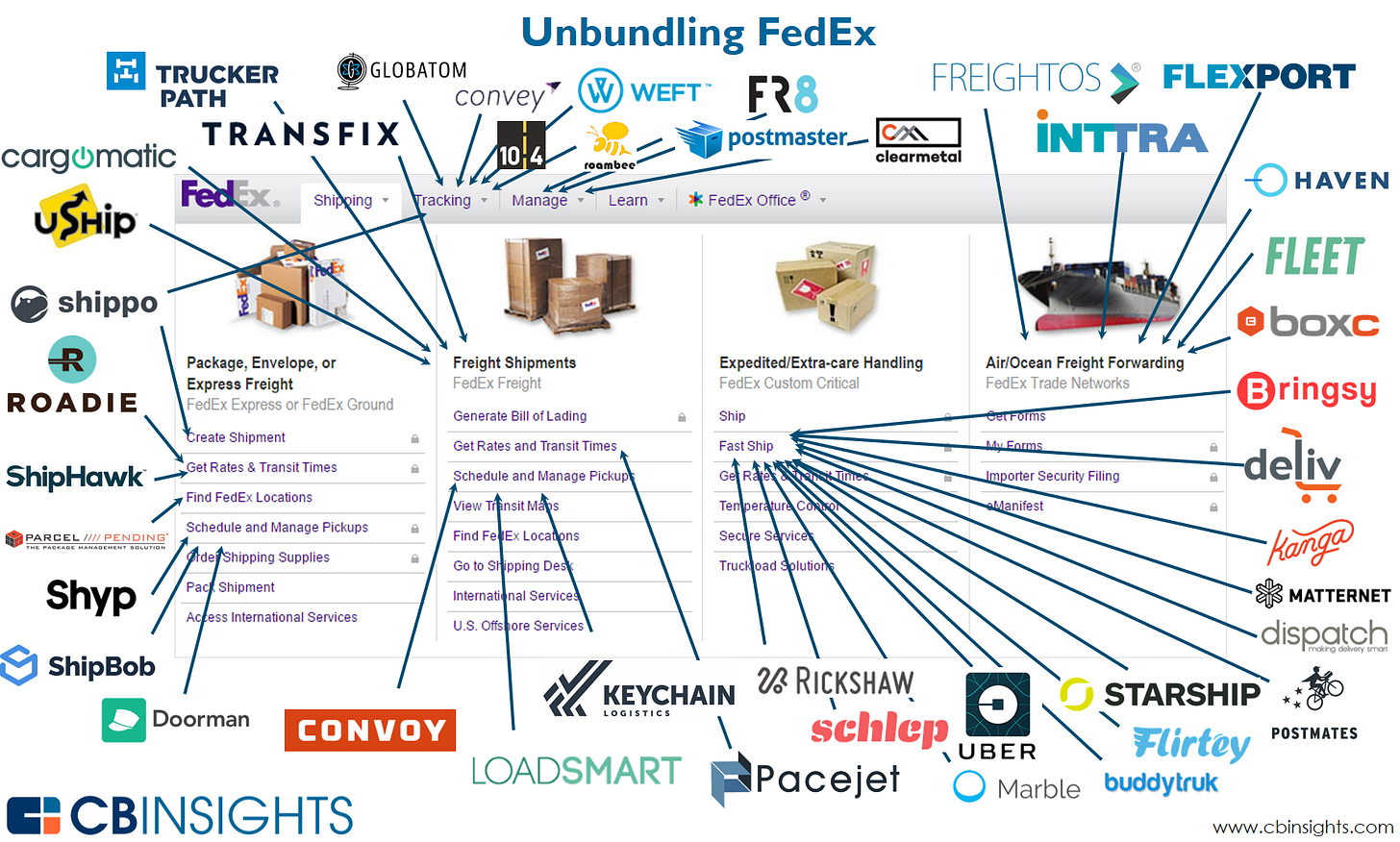

In 2016, CB Insights created a now famous graphic called the The Startups that are Unbundling FedEx and UPS.

While the graphic is quite old and many of the listed startups are already gone, the article foreshadowed what was to come — that FedEx, UPS, and DHL would face competition in all it’s businesses.

But the graphic was wrong in that competition wouldn’t only come from startups, it would come from everywhere all at once.

Marketplaces’ Take Logistics In-House

Marketplaces have always had the largest share of eCommerce globally, and as a result, many parcel carriers’ growth stories have been intertwined with the marketplaces that they served — but those days are coming to an end.

Today Amazon delivers as much as 64% of it’s orders in house. For several years, the trend has been for the largest marketplaces to take it’s logistics operations in-house — no doubt inspired by Amazon’s success. It typically starts with fulfillment, perhaps cross border shipments, and finally last mile delivery.

In China, the world’s largest eCommerce market, Alibaba and JD’s logistics arms Cianiao and JD Logistics now dominate the logistics services provider scene. In South East Asia, Shopee Xpress and Lazada Logistics (owned by Alibaba) employ a similar tactic. And in parts of Europe, marketplaces like Vinted have started offering their own logistics services as well.

In virtually all cases, the marketplaces first starts by taking the most profitable highest density deliveries for itself, leaving less desirable orders to it’s once loyal carrier partners. Then as those carriers start to reel from the loss of those volumes and begin to see their economics destabilize, the marketplace then moves in to services non-marketplace shipments, directly competing with the carriers.

Because the majority of eCommerce globally is still marketplace driven, this positions the marketplaces’ logistics companies to dominate the parcel delivery market, while leaving only a minor share of the market to the private carriers. It’s bad.

Gig-Delivery - Asset Light

Amazon’s delivery model utilizes gig-delivery, meaning drivers are not full time employees like they are at the Big 3, but are instead independent contractors. It’s like food delivery, except for parcels.

Gig delivery isn’t new. Amazon first tried it in 2018. Food delivery companies and other gig worker and task rabbit types of companies have tried it before, but they failed and were written off as an idea that was good in theory only. Amazon shut down their gig delivery in 2020.

But in 2023 Amazon quietly relaunched Amazon Shipping, and something was different this time. It was working, and it was working really well. It’s working so well that 64% of Amazon’s deliveries are now handled in-house.

And it’s not only Amazon. Gig delivery startup UniUni, which started out in Canada, has expanded into the US, and is growing like a weed, raising a $70M Series D to fuel it’s growth. All around the world, and even in the US, other gig delivery startups are raising money from Venture Capitalists (VCs) in a frenzy to mimic UniUni.

Why gig delivery has been successfully reborn is a post for another time, but the implications are very bad for the Big 3. Gig delivery companies are asset light lean technology companies. They may be better suited for a constantly changing future where agility and speed play a critical role in a carrier’s success. And every package that they deliver is one less package delivered by the Big 3.

The Rise of Cainiao and JD

Chinse Logistics giants Cainiao, which is owned by Alibaba and filling for IPO, and JD Logistics (HKEX 2618.HK) have been expanding rapidly across the globe. These vertically integrated logistics providers can handle your freight forwarding from your factories all they way to doorstep delivery of your eCommerce shipments.

With their unstoppable growth, frightening speed, innovation, and technology first mindset, and the Big3 are on a collision course for these two companies which are both younger and hungrier.

Both companies are already operating in the US. Despite they primary still serve Chinese and Asian businesses that are more familiar with their brand, time is on their side.

Quick Commerce Dashes into the Fray

Quick commerce is rapidly emerging as a new high-growth segment of eCommerce, but rather than traditional carriers, gig-delivery companies usually with a DNA in food delivery, are the ones taking the market. Dubbed “Quick Commerce”, these companies operate an on-demand point-to-point model unlike the hub and spoke models of the Big3.

In China, quick commerce grocery company Ding Dong Mai Cai recently turned profitable and has triggered an all out war between Chinese giants MeiTuan, Alibaba, and Jing Dong (JD). Dubbed the Quick Commerce 2.0 Death Battle, this battle has witnessed $11B in subsidies poured into the market to fight for market share.

In the US, we can already see the initial gesture of a Quick Commerce War, potentially between Amazon, Walmart, DoorDash via Dashlinks, and Uber Eats. Every week we see new announcements of Quick Commerce deals for instant daily deliveries that excludes the Big3.

Increasingly non-grocey Ecommerce shipments are being delivered by companies like Glovo in Spain or Grab and Food Panda in Asia.

It is yet another market trend that is chipping away at the core business of the Big 3.

The Parcel Locker Companies Acquiring Parcel Delivery Companies

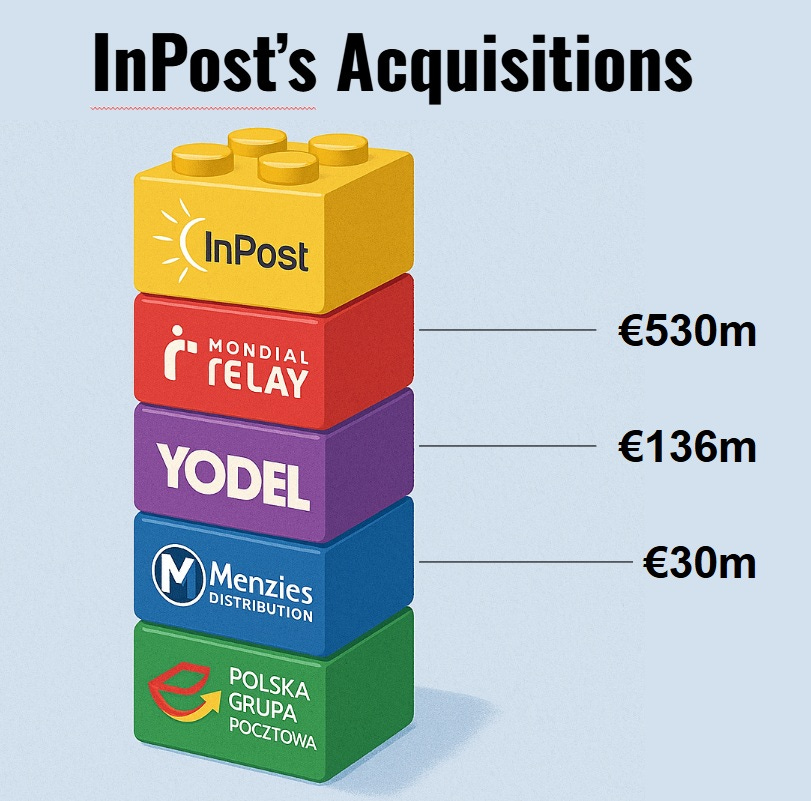

If you haven’t heard of InPost (AMS: INPST), you need to know them. They are the parcel locker company from Poland that has become so insanely big and profitable that they have acquired one of the largest parcel carriers in the UK, Yodel.

Not only that, but they previously acquired French carrier Mondial Relay, and they recently acquired Spanish carrier Sending.

Also known as Out-Of-Home (OOH) or PUDO (Pick Up, Drop Off), this is yet another business that is seemingly taking large chunks of market share away from the Big 3. The driving factor for OOH is that OOH profit margins are far better than parcel delivery. The reason being that most of the cost of delivery is in the last mile, and OOH does not need to deliver to the door.

With InPost throwing off over $1B in profits per year and rapidly acquiring traditional carriers, the Big 3 once again appear to be sitting on the sidelines as companies like InPost and their peers were the ones to unlock new innovation and realize the true value of Out-Of-Home.

It’s worth nothing that DHL operates large parcel locker networks in Europe and in parts of Asia, and that UPS has acquired the largest Drop Off returns provider in the US, Happy Returns, but FedEx is largely on the sidelines. While this is good step, companies like InPost have made it clear that one of their growth strategies is to acquire traditional parcel delivery carriers, then make them insanely profitable by rerouting those deliveries into parcel lockers.

All the Cross Border Injection Providers

For years rag tag armies of crossborder direct injection specialists have been cutting away at the high-margin crossborder express delivery business. They do so by consolidating all parcels at origin ironically often with destinations delivered by the Big3, and injecting into a destination local carrier like the postal service or other service providers at destination to beat the Big3 on price.

Often described as “cheaper than express” and “faster than postal, ” the biggest players include postal related companies known as ETOE’s which include postal subsidiaries like Asendia, Spring GDS, Landmark, APG, and formerly Quantium. At the next level down, you have country specific players and specialists such as Passport or ePost Global in the US, Starlinks Global or ProCarrier in the UK, Dai Post or Seko in Australia, and the list goes on.

While the Big 3 have their own versions of these business including DHL eCommerce, UPS Mail Innovations (MI), and FedEx International Mail Services (FIMS), these units represent a conundrum in their strategy as they seemingly cannibalize their higher margin in-house business and give volumes to their competitors.

The Big 3 Fight Back

But all is not doom and gloom for the Big 3. As $100B companies, they have massive infrastructure, reach, customers, resources, and talent. Let’s examine some of the strategies that they betting on.

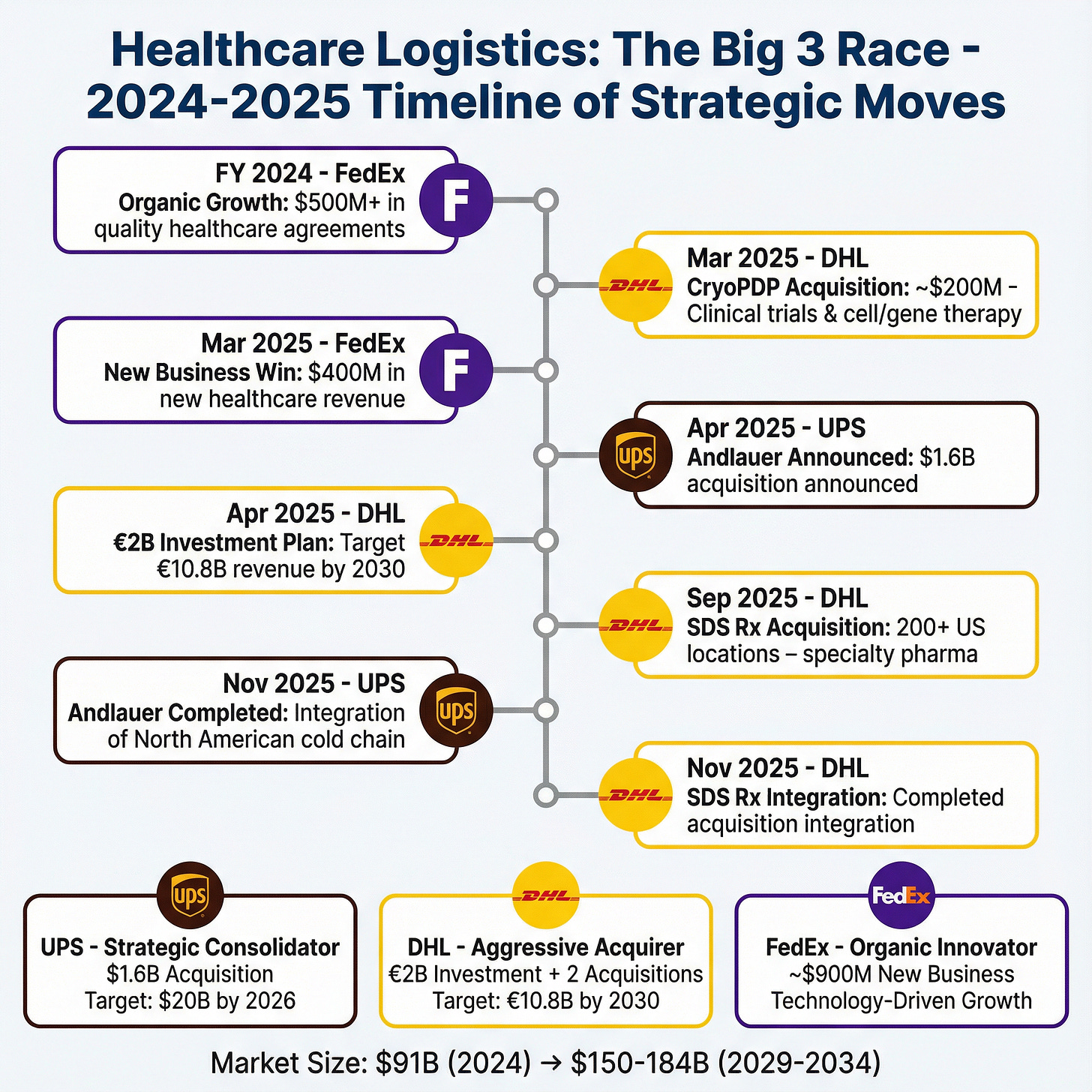

Pharma and Healthcare Logistics

The Big 3 seemingly are all betting their future on Pharma and Healthcare logistics which seems to be paying off.

UPS Major Acquisitions:

Andlauer Healthcare Group $1.6B

Frigo-Trans & BPL, value undisclosed

DHL Major Acquisitions and Investments:

CyroPDP $200M estimated

SDS Rx, value undisclosed

Invest €2 billion by 2030

Goal of €10.8 billion in revenue by 2030

FedEx Major Announcements:

$900M in new healthcare business

Purely organic growth

Fulfillment and Contract Logistics

The Big3 are also making bets into the fulfillment space. The challenge they face is that the enterprise-level-fulfillment business don’t scale like the parcel business. A typically fulfillment company may run just a few brands out of 1 warehouse location. Bleckmann has $1B a year in revenue, Staci similar, Shipbob while undisclosed has hired a CFO with the experience to help them IPO, etc. Squeezing millions of packages per day out of a fulfillment business is going to require them to get to the size of Shipbob very fast which might not be possible.

Even if they figure that out, fuflillment customers ship with multiple carriers at scale, so how much of that really ends up with the Big 3 given there are so many carrier options available to shippers?

Maybe UPS figured this out and that’s why they recently sold Ware2Go?

Freight Battle Ground

After selling off its LTL business T-Force Freight in 2021, UPS is getting back into the space, sensing strong margins as rate remaining strong.

Some analysts have stated that this is smart, since rates have been increasing now that players like Yellow and Convoy have wound down, and FedEx has been scaling back it’s freight business.

But is it really strategic foresight to exit a business and then re-enter it 4 years later? Or is it a knee jerk reaction to running out of options?

The timing couldn’t be worse for UPS as Amazon Logistics is similarly launching an LTL business in addition to it’s FTL.

Are We a Technology Company Yet?

FedEx is trying to become a software player with their acquisition of RouteSmart and the launch of FedEx FDX, a digital solutions suite including post purchase software, but is it possible for a logistics company to transform into a technology company?

The road to becoming a real technology company is littered with the corpses of non-tech companies who were unable to transform their company culture into that of a software development, digital product management, and engineering first business.

Small wins such as launches of consumer tracking apps may help the Big3 to become better atuned to their digital consumer facing side, but what would the true path to tech look like? Would the Big3 because pure tech houses like Descartes, Blue Yonder, and Manhattan? Or would it look something more like Uber and DoorDash?

Out of Home (OOH) and Returns

As mentioned earlier, Out of Home (OOH) has been a windfall for carriers worldwide. While FedEx and UPS have largely sat on the sidelines for OOH, DHL has seen very positive growth in operating margins by deploying OOH networks within the EU.

While US market has been slow to adopt parcel locker style OOH that has been helping DHL and it’s European peers, it has somewhat embraced Happy Returns’ Drop Off Returns model which UPS has the foresight to acquire.

DHL has also made a move by acquiring the Returns business of Inmar. FedEx has thrown it’s hat in with Blue Yonder, which also previously acquired Doddle, giving all 3 companies a play in the returns market.

While these moves may not be huge, at least they keep the Big3 in the game.

What’s the Next Big Fing for the Big3

If we compare the external threats to the Big3 against the opportunities, the new opportunities don’t seem like enough to offset the potential threats. Therefore, without a breakthrough strategy, the best the Big3 might hope for is just to be filthy cash rich — which is still a great thing and a great business. Legacy forwarders are a great example of what the Big3 can aspire to become. Their stock businesses failed to match the Big3 decades ago, but they are doing perfectly fine as companies that make decent profits without any expectation that their stock prices will ever look like the Magnificent 7.

But what IF the Big3 were to try something that aligned their strengths to the new opportunities? Just take the most basic of frameworks:

If you’re not growing, you’re dying - so find something BIG.

Go to where the puck will be, not where it is - the FUTURE.

If you don’t disrupt yourself, somebody else will

The strengths, or the assets of the Big3:

Logistics and delivery infrastructure that nobody can compete with

A truly global and scaled sales force that is the envy of every company

A brand name that can always get a meeting booked

Mostly solid fundamentals, and with a strong balance sheet

The answer might be to completely embrace AI and Automation (hardware and software) and utilize that existing delivery infrastructure to obtain exponential results, while lowering costs of delivery by adopting and deploying automation at scale.

In other words, become an expert at the design, deployment, and operation of logistics automation at scale, while owning all of it. Actually one might say that this is in fact what Cainiao, JD, and Amazon have already identified and are trying to do. Cainiao, despite being treated like a Logistics Services Provider, considers itself to be a technology company first and foremost running massive R&D projects, focused on engineering and technology implementation, and managing all of the logistics operation.

It’s not Over Yet

Despite the many challenges that the Big3 face from marketplaces taking logistics in-house, asset light gig-delivery, the coming quick commerce wars, and the rise of out of home delivery, we can see that the Big3 are fighting back by getting into healthcare and pharma logistics, dabbling into fulfillment, revisiting freight, and cautiously looking at technology and out-of-home plays.

They are still nearly $100B per year businesses with some of the largest physical assets and infrastructure in the world, and they have strong balance sheets, strong partners, and strong supporters.

The question is not whether they will survive, but whether they will stagnate like the last generation freight forwarding companies that they disrupted, or whether they can indeed find their inner unicorn again.

About The Ecommerce Logistician

If you enjoyed this article please consider sharing with anyone who might benefit from this analysis. Also please consider subscribing to this blog - it’s completely free. Donations welcome.

DISCLAIMER: This article is solely an opinion article on the industry and does not reflect the opinions of any companies with which we are affiliated besides The Ecommerce Logistician media platform. The post is neither directly sponsored nor endorsed by any companies or businesses mentioned in the articles.