Traditional logistics company's distributed P&L structure needs to die

Why the old model made sense and what needs to happen to fix it

If you’ve ever worked for or dealt with the same traditional logistics company, but in multiple countries, you will likely have experienced what I deal with all the time —

— which is that aside from sharing the same name, the two countries’ might be totally different!

Different IT systems, different quoting structure, different bank accounts, different services, different marketing, and little to no collaboration between the company’s countries.

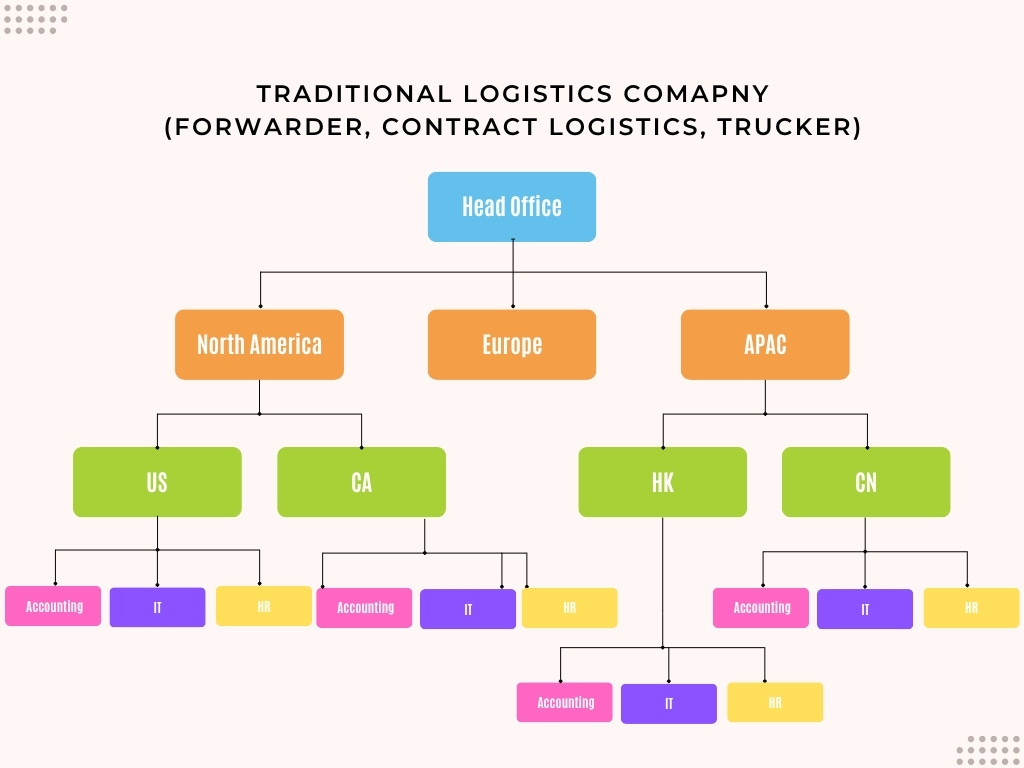

This is because these traditional logistics companies are typically structured as completely separate independent entities with entire supporting functions duplicated within each P&L.

If a freight forwarder has operations in 20 countries, this potentially means that there are 20 different accounting teams running on 20 different accounting systems. Now it’s usually not that bad — as it’s possible many of the countries use the same accounting software — but they probably don’t talk to each other and they’ll probably give you an excuse like it’s a matter of data privacy.

This kind of terrible customer experience is slowly destroying the brand equity of the biggest traditional companies as anyone outside of that circle simply view these big brands as having highly inconsistent products and services, and failing to communicate internally between themselves.

In the past, when real time instant communication via the internet wasn’t possible, this localized P&L structure might have made sense, but in today’s fully connected world, where business customers themselves are becoming more globally sophisticated, this model is preventing traditional logistics companies from growing and innovating, and if the traditional logistics companies don’t get their act together, they will continue to stagnate into irrelevance.

Even if these traditional companies are able to grow, innovation can be inconsistent across countries and business units, with the headquarters acting more like a portfolio manager than an as a strategic executive team.

How to Fix It

Logistics companies should look to the newer tech companies for inspiration. A considerable number of highly scaled tech companies that are barely 10-20 years old AND are worth far more than the traditional logistics companies, are organized by function in a centralized structure.

The greatest benefit of this model is that the executive team regains control of the organization and the ability to lead it to make transformational change.

Equally important is the ability to drive consistency across the customer experience through coordinated product and service development.

Lastly, this model is superior for attracting talent. Professionals in this type of org chart have a direct line reporting to the executive suite. For example, a fresh grad junior accountant has a direct path to both learning from and become the CFO of a multi-billion dollar organization.

In the decentralized models, however, a fresh grad junior accountant will know that they could only ever aspire to become head of accounting of their local $10M P&L. Junior engineers want to work with and be mentored by a qualified CTO, and generally do not want to report to a business person (sorry).

In today’s world, we are connected in real time. Professionals are generally adept at navigating cultural differences thanks to YouTube and low cost travel, and language has become less of an issue thanks to Duolingo and Google Translate.

2nd Best Option: Change KPIs

The traditional KPIs also encourages P&L leaders to amass headcount and build fiefdoms which is very bad for the company. If changing or structure is not possible, companies could measure P&L leaders by tech KPIs such as Revenue Per Employee, and Profit Per Employee. This would force P&L leaders to start moving their back office functions to lower cost countries or automating those functions as much as possible in order to improve their KPIs.