Shein and Temu Aren't Winning Because of de mininis

And they also won't die without it.

For a brief moment last week, when the de minimis termination for Chinese imports seemed all but certain, many professionals in the eCommerce industry prematurely trumpeted the demise of Shein and Temu.

Many of these individuals have an oversimplified view of why Shein and Temu are successful, believing that the business models of these companies were solely reliant on duties and tax arbitrage.

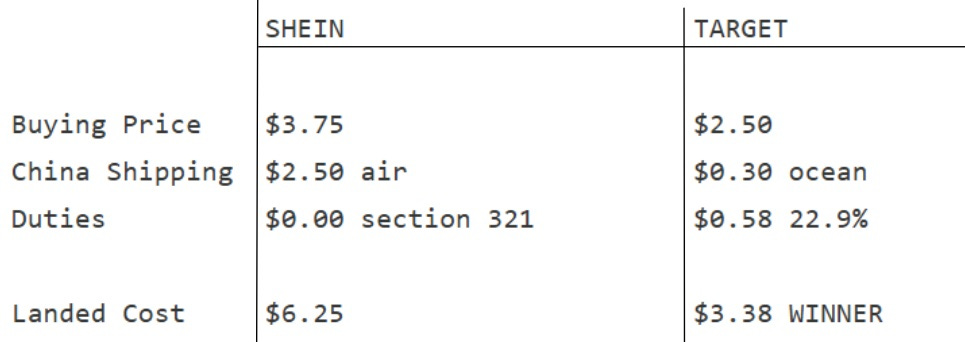

The irony in this argument is that companies like Shein and Temu have both higher product and logistics costs than their competitors. Let’s consider the cost structures of Shein vs Target for a moment.

By all three measures, Target is the winner. It has a lower buying cost on bulk purchasing, lower logistics costs by bulk shipping, and it has an added advantage on delivery speed. Let’s consider the cost of a Women’s Woven Top at 200 grams.

Target is the clear winner with a significantly better landed cost. So how are Shein and Temu winning?

Lower Operating Costs

Until recently, both Shein and Temu’s global operations were largely centralized in the Guangdong province of China.

(1) The centralization of decision making

(2) Speed of localized communications

(2) Lower overhead costs in China

Give Shein and Temu an advantage that cannot be replicated by a US based retailer like Target.

Manufacturing Cluster

Both Shein and Temu situated themselves in the heart of China’s manufacturing industry, namely the Guangdong manufacturing cluster which is known for apparel, accessories, electronics, and many other consumer products. With more than 10,000 factories within a 3 hour drive from their offices, this proximity grants them several distinct advantages.

Rapid Prototyping

In 2016 Shein hired 800 full time designers. These designers, who have their ears on the market, can come up with a new design, have it prototyped, and listed for sale within 2-3 days. There are more than enough factories at their disposal, and within reach, so that responsibility for quality can also be controlled. The result is that Shein and Temu are listing thousands of new SKUs onto their sites daily, moving faster than competitors and giving customers fresh and exciting products daily.

Constant Replenishment

Being within a 3 hour drive allows both companies to procure in micro lots as small as 100 units at a time — which they do daily. By procuring in constant micro lots, the companies never need to make huge bets on designs, nor do they tie up their cash in inventory, nor dedicate resources to clear slow moving stock. Any professional who’s had to write off thousands of unsold product knows just how badly this hurts.

Quick Response

The combination of rapid prototyping and constant replenishment, mixed with a strong culture of relying on real time data, which includes proprietary algorithms, allow the companies to respond immediately to new designs that will perform well or to stop procuring a product that will no longer be in favour.

Controlled Product & Shipping

Shein and Temu closely studied the past successes and failures of companies like Deal Extreme, Light in the Box, Aliexpress, and Wish. Both understood that the risks of poor product quality and non fulfillment was enough to destroy the brand, and so they took full control of their logistics. Everything is in stock and nothing is dropshipped. With the proximity to their thousands of suppliers, their warehouses are receiving POs daily.

Keep it Simple Stupid

The simplicity of a supply chain that went from Southern China directly to any consumer in the world at a parcel level was brilliantly simple and straightforward. Rather than hire thousands of logistics professionals across global time zones to manage distributed inventories, stocks, and warehouses, everything originated from their own warehouses and that was it. While this model has changed significantly in the past few years in preparation for the end of the de mininis, it was this model that allowed them to obtain their current scale of operations.

Will They Survive Without de minimis?

At the end of the day the real question is whether consumers would abandon Shein and Temu due to higher prices paid on import. If that’s the case we have to look at the impact on the prices at full tariffs. Again, let’s suppose the Woman’s Woven Top:

If Shein now needs to pay 25% more, making their product $12.50, will consumers abandon them? Then, factor in the following:

(1) Shein’s design is a new listing, Target’s was set 4 months ago

(2) Shein still has a better recommendation algo, better influencer marketing (we didn’t even discuss this yet)

(3) The application of tariffs on a transfer pricing is still possible, so 25% may be a high estimate

(4) Traditional retailers have to factor in dead stock cost to their numbers

Finally, the closure of the de minimis is not a “gotcha” moment. Both companies have been preparing for this for the better part of the year.

So will losing the de minimis kill Shein and Temu? My answer is no. It was never the key reason they were winning to begin with.