ReturnGO acquired by Global-E (GLBE)

Now only Loop and AfterShip remain.

ReturnGO – the 3rd biggest player in the returns space – has been acquired by Nasdaq listed Global-e (GBLE). What does this mean for customers, competitors, and the market?

The returns software space has been on a roller coaster ride these few years!

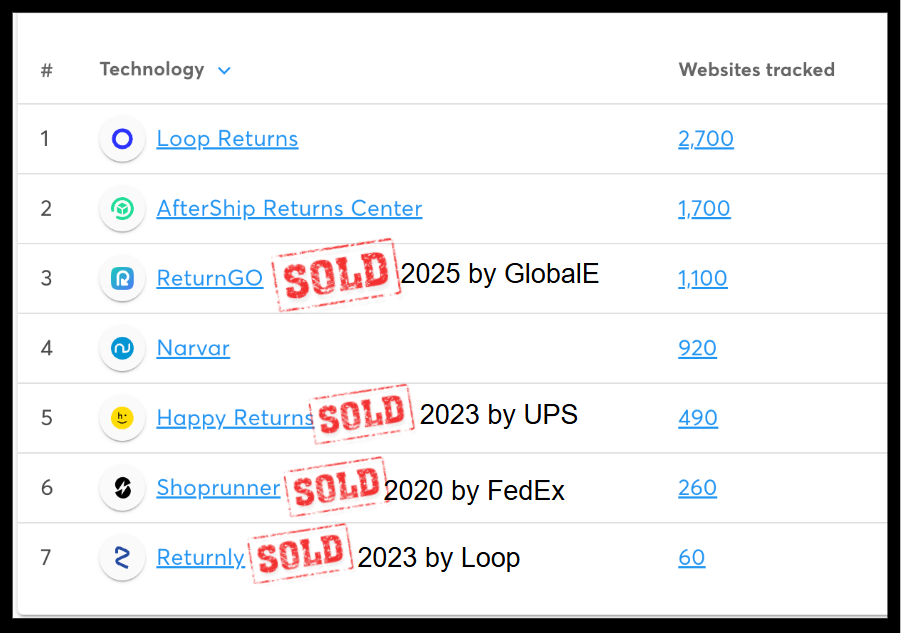

From Loop’s acquisition of Returnly several years ago, to UPS's acquisition of Happy Returns, a UPS Company, the space has recently been a 3-way contest between Loop, AfterShip, and ReturnGO according to data from Wappalyzer.

But with ReturnGO now under the wing of a $5B public company like GlobalE, which provides cross border checkout and shipping label creation, will ReturnGO continue as an independent product and company, or will it merge into the product portfolio of GlobalE?

The press release from GlobalE seems to imply the latter, and the company also indicated that there will be no material impact on GlobalE’s revenues, indicating that ReturnGO is small and therefore is better off being fully absorbed.

This would leave a lot of questions for existing ReturnGO users. Will they continue to be supported?

Who are ReturnGo users? Are they more likely to gravitate towards Loop and AfterShip, or would they go more downstream to SMB solutions like Redo?

What does Shopify think about this? Shopify owns 13% of GlobalE, and it’s also an investor in Loop.

Real money wise, Shopify’s 13% stake in a $5B public company worth 5B is probably more strategically significant and important than its stake in Loop.

Would it feel compelled to start doing more with ReturnGO? Or would it rather divest it's GlobalE partnership?

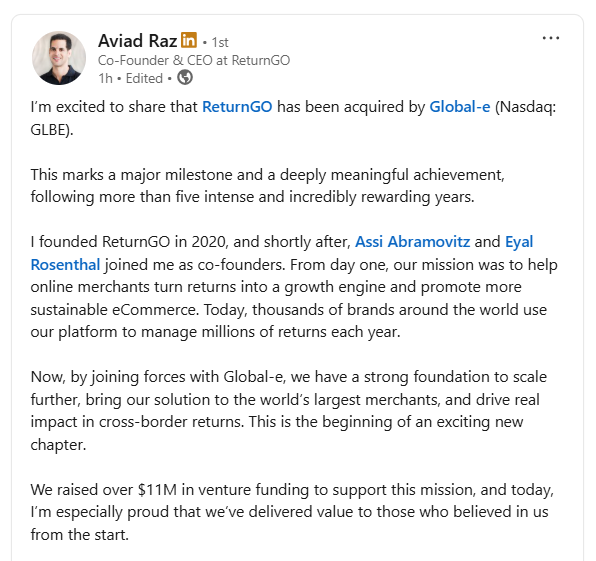

Founded in 2020, ReturnGO raised $11M in VC funding. CEO Aviad Raz announced the acquisition 31 July 2025 on his personal LinkedIn just minutes after the official announcement.

ReturnGO and Global-E made separate parallel announcements on their LinkedIn as well.

The acquisition price was undisclosed. Having raised USD $11M in it’s last round, that likely puts the valuation between USD $30-$50M, and typically there might be a mix of cash, stock, and earn out mechanisms.