Resale platform software: The next VC blood bath

VC's are pouring into yet another fad

Fresh off losing their shirts from investing into Returns Management SAAS companies, VC’s are now pouring into an even smaller niche segment of eCommerce returns: resale platform software.

Companies like Archive, Trovet, and Treet have raised over to $200m from VCs to solve the even-smaller-problem of brands and retailers needing software to help them create a either a marketplace for their customers to resell their used products, or a a secondary eCommerce front to sell used and refurbished products directly.

First let’s look at the companies, then I’ll explain why the VCs are going to lose their money again.

Archive | www.archiveresale.com | total funding $54.3m

Archive partners with brands to launch and scale brand-owned resale programs, creating customized, omnichannel resale experiences

Modes supported include peer-to-peer marketplaces, trade-ins, returns management, and past inventory resale

Resale intelligence software includes price optimization, logistics, and inventory management

Integrations with logistics providers offering greenwashed services like environmentally-friendly cleaning, footwear renewal, and digital product passports for traceability

Last round: $30M Series B in February 2025, led by Energize Capital, with participation from LightSpeed Venture Partners, Bain Capital Ventures, others

Trove | www.trove.co | total funding $152.5m

Trove helps brands like Patagonia, Lululemon, and REI launch white-label resale platforms including trade-in for store credit

They handle the entire resale process, including product intake, cleaning, pricing, and fulfillment

Trove emphasizes sustainability by extending the lifecycle of products and reducing waste

Last round: $30m Series E in in 2023 from investors including G2 Venture Partners and Wellington Management

Treet | www.treet.co | total funding $16.4m

Treet enables brands to create peer-to-peer resale marketplaces where customers can buy and sell pre-owned items directly

They provide tools for product authentication, pricing, and logistics

Their platform is designed to be easy to integrate with existing ecommerce systems for quick launch

Treet focuses on community-driven resale, encouraging customers to participate in circular fashion

Last round: $10m Series A in March 2024, led by Two Sigma Ventures, with participation from Techstars, First Round Capital, and Bling Capital

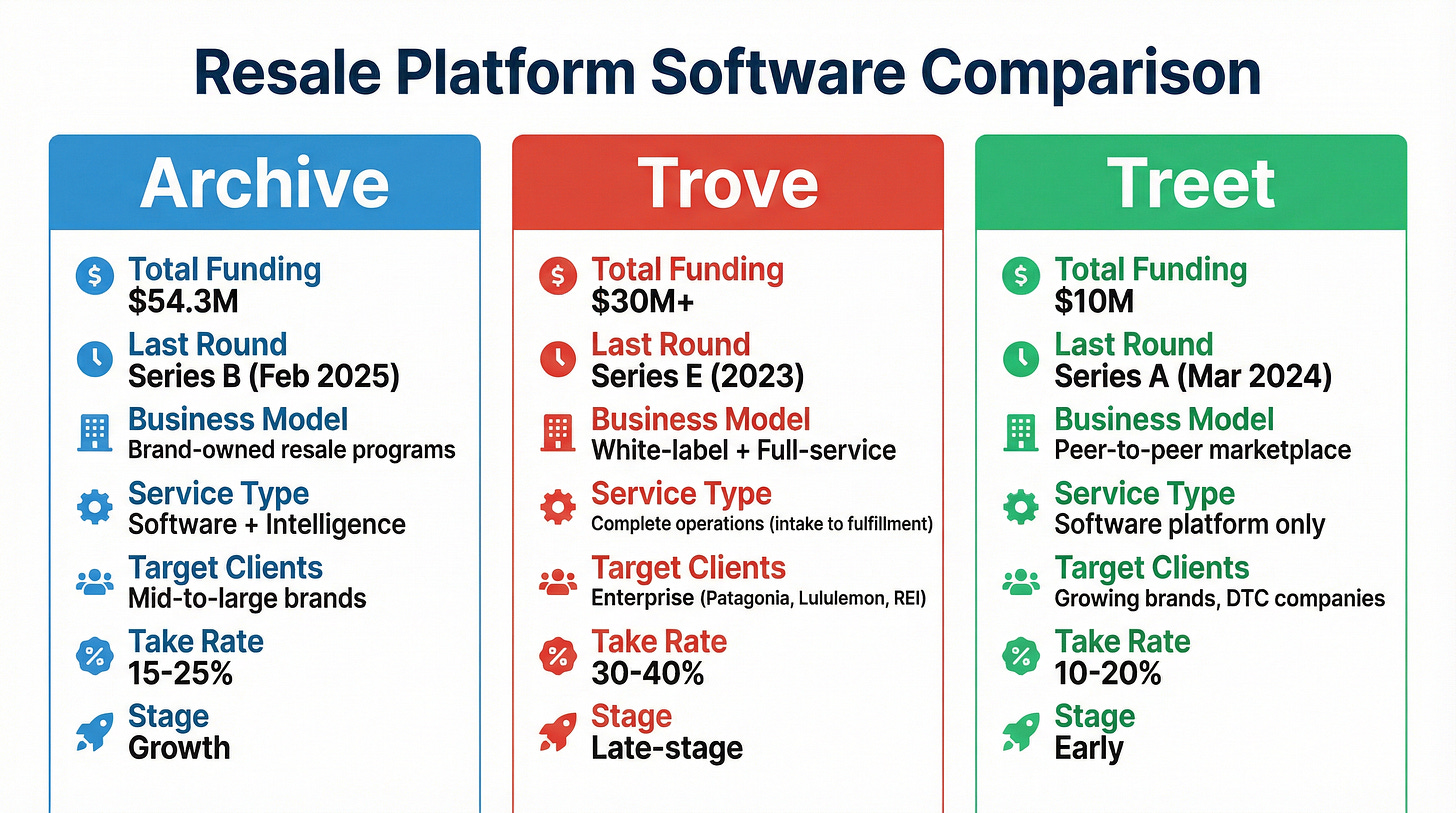

Comparison of Archive, Trove, and Treet

The Problem with the VC Model

Despite my criticisms of the amount VC funding for these businesses, I like the concept. In fact, prior to joining AfterShip as an employee, I had written up a pitch deck for creating my own resale app myself! The problem isn’t the business model, the problem is the VC model.

VC’s have a well documented model. If you don’t understand it, go and read “Secrets of Sand Hill Road: Venture Capital and How to Get It”. Here’s how VC’s work:

Startups raise VC and are given multi-million dollar valuations in order to justify the investment, then typically have 18 month of runway to build the business before they run out of cash

Already worth millions or tens of millions on paper, in order to raise the next round, they must focus all their time and energy on boosting revenues and growing ultra fast, or they will die after 18 months since they are intentionally loss making

If the business discovers that they have a low ceiling or are not growing fast enough, they must make risky decisions (even reckless or wasteful) because they have started to play a game of grow-or-die (aka “go big or go home”)

VC’s only make money on homeruns, so prefer that their portfolio companies (PCs) swing for the fences and are 100% comfortable with the PC striking out even if it means wiping out the company, it’s customers, management, and other shareholders

As the VC needs every investment they make to have the chance to exit for $500M, valuation growth needs to look something like the following

$5M Series A valuation

$25M Series B valuation

$100M Series C valuation

$250M Series D valuation

$500M - 1 Billion Series E valuation

With every round the startup successfully lives through, they must repeat the grow-or-die cycle in a crush to grow revenues fast enough to justify that next round

TAM SAM SOM for the Resale Market

Now that you know this, you’ll see why startups like ThredUp are forced to convince VC’s that their market is worth $73b. Otherwise the VC would never be able to hypothesize a $500m - $1b exit, thus never investing.

Is $73b REALLY the total addressable market (TAM) of ThredUp? Possibly. But the real question is what is the SOM.

TAM = Total Addressable Market (the total economic activity for second hand fashion and apparel goods in the USA) …say $73B

SAM = Serviceable Addressable Market (all second hand apparel products that they actually have access to and that people are willing to buy online) … say $20B?

SOM = Serviceable Obtainable Market (the buyers/sellers that don’t prefer to do sell it through eBay or Amazon and like going to a ThredUp marketplace) … say $5B?

Using these overexaggerated numbers to raise money from VC’s, ThredUp convinced investors in their 2019 Series F to pony up $175m at a $670m valuation. When it finally IPO’d it hit a $1.3B valuation. However, since then reality has caught up with them. 6 years later as a public company it’s market cap has fallen 77% to $302m.

The Numbers Don’t Add Up

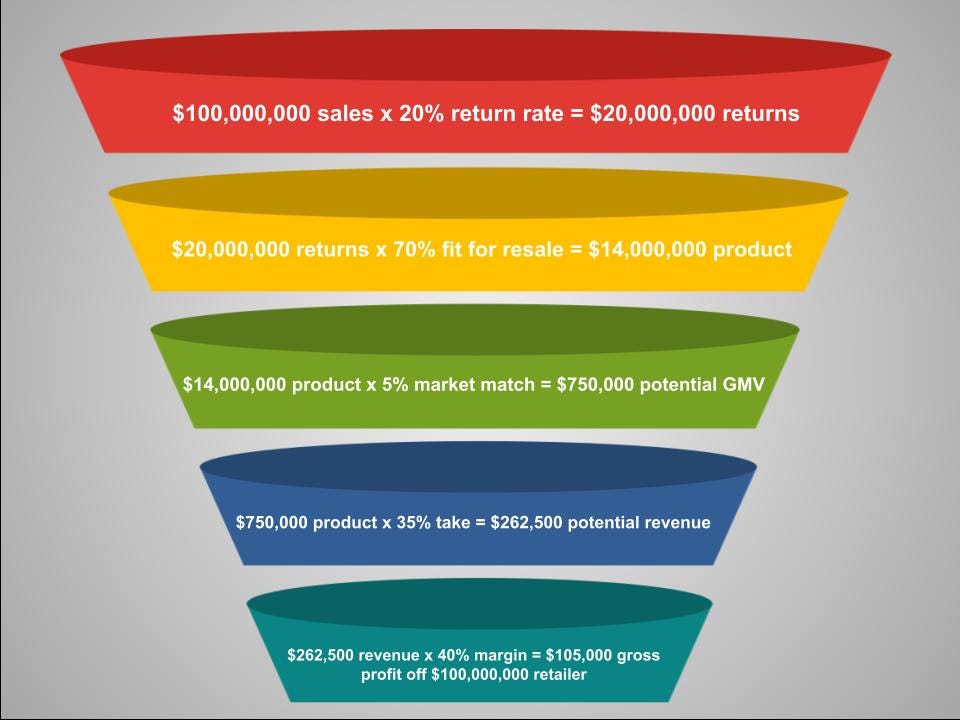

Anyone in eCommerce SAAS or logistics already knows that returns is a 20% problem for retailers, meaning that if a company does 10,000 orders a month, they potentially have 2,000 returns.

What percentage of those returns are suitable for resale? Let’s be generous and say 70% of that. With all the various old collections, off season, what is the probably that a buyer and seller of the same SKU match? Perhaps 5%, or $750K. Of $750,000 GMV how much in fees might the software platform take? If they are managing the sales process, logistics, and marketing it might be high - as much as 35%. If they are provided the typically low margin logistics services, then let’s assume that they have a blended gross margin of 40%. Our final numbers look like this:

$100,000,000 sales x 20% return rate = $20,000,000 returns

$20,000,000 returns x 70% fit for resale = $14,000,000 product

$14,000,000 product x 5% market match = $750,000 potential GMV

$750,000 product x 35% take = $262,500 potential revenue

$262,500 revenue x 40% margin = $105,000 gross profit off $100,000,000 retailer

That is not a bad number, but it won’t help the startup make their next funding round. In order to make it a VC worthy number, the start-up needs to get into all sorts of crazy services in order to justify it’s revenue and meet it’s next fundraise. Those ideas can be the things we’ve seen many times before, including:

White labelling the software

Running a marketplace (B2C, C2C)

Providing logistics services to other companies

Turning into an IPAAS

Buying used product from other others

Reselling the product yourselves on eBay

Selling ads

Doing consulting

Acquiring non VC backed companies to add revenue and gross profits

In the end, what we really need is a for a non-VC backed resale platform gain traction so that it can focus on the problem and the users, free of 18 month countdown.